Mutual Funds

A Mutual fund is a combination of many stocks and bonds. The mutual fund pools cash, giving the investor the ability to purchase small pieces of stocks, bonds, or a collection of assets, and simultaneously providing investors a cheap way to diversify and reap market gains, while still hedging against losses. Professionals manage the holdings that make up the fund’s portfolio. Investors buy shares that rise or fall in value based on the performance of the fund’s underlying securities or holdings. Unlike stocks, mutual fund investors do not have direct ownership or voting rights of the stock; however, mutual fund investors do share equally in the profits or losses of the fund’s total holdings.

Owning a single share of Amazon would cost approx. $2,300 today; however, there are many mutual funds that cost less than $30 per share. The mutual fund owns Amazon, and other stocks such as Apple, Johnson and Johnson, Ford, etc. So, the investor can still own a diversified group of these expensive stocks for a much cheaper rate, concurrently reducing even more risk through diversification. Some mutual fund companies focus mainly on small cap companies, or just fixed income; knowing your asset classes are still a very important factor in the investment portfolio.

Since all mutual funds are professionally managed, it cost money to buy shares of mutual funds. At Schenley, we give our clients the institutional share class expense ratio, which gives us the ability to pass on a lower cost to our clients when purchasing mutual funds with us. Mutual funds are priced once a day after the market closes at 4:00 P.M.

ETF’s

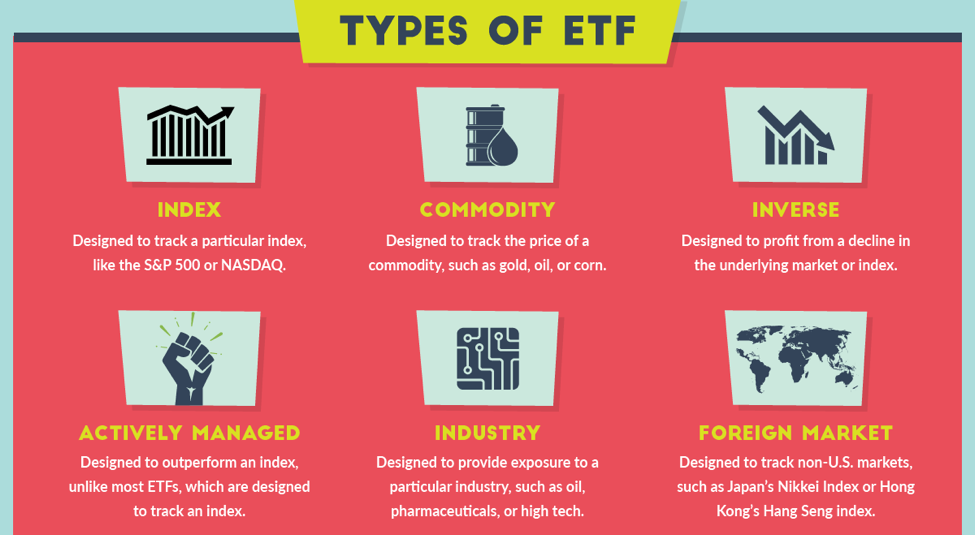

Exchange Traded Funds (ETF’s) have the ease of trading exactly like a stock, meaning the price of the ETF changes by the minute, and changes within the trading day. ETF’s also have the diversification benefits of mutual funds, usually with lower costs. The underlying goal of an ETF is to track the current index and follow it based on the pool of selections, including stocks and bonds. It’s not a stock, not a bond, and not a mutual fund, but its own fund that can be traded on an exchange. There are different types of ETF’s, but the main one being index exchange traded funds. ETFs give you a way to buy and sell a basket of assets without having to buy all the components individually.

The fund provider owns the underlying assets, designs a fund to track their performance and then sells shares in that ETF to investors. Like mutual funds, the shareholders own a portion of an ETF, but they don’t own the underlying assets in the fund. Investors in an ETF that track a stock index get dividend payments, or reinvestments, for the stocks that made up the index.

An example of an index ETF would be to purchase the S&P500. You would have 500 large cap companies in your portfolio, which essentially gives you a sizable reward with the least amount of risk. An investment in the S&P 500 ETF earned 28.8% last year but lost 6.24% in the prior year. ETF’s are an extremely low-cost way to invest in a group of stocks or bonds, which will diversify your portfolio and reduce risk.

If you have any questions or concerns about stocks, bonds, mutual funds, or ETF’s, or if you want to get started investing, please do not hesitate to reach out to one of our advisors at Schenley. We look forward to hearing from you.

Click the link below to view “What you need to know about Stocks & Bonds”