Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”. So, what is this compound interest Einstein spoke about? The definition of compound interest is the interest associated with your bank account, loan, or investment account increasing exponentially, not linearly. In simple English, this compounding effect can be thought of as a snowball rolling down a large hill. The snowball can begin very small, but depending on the size of the hill can end up being quite large in the end.

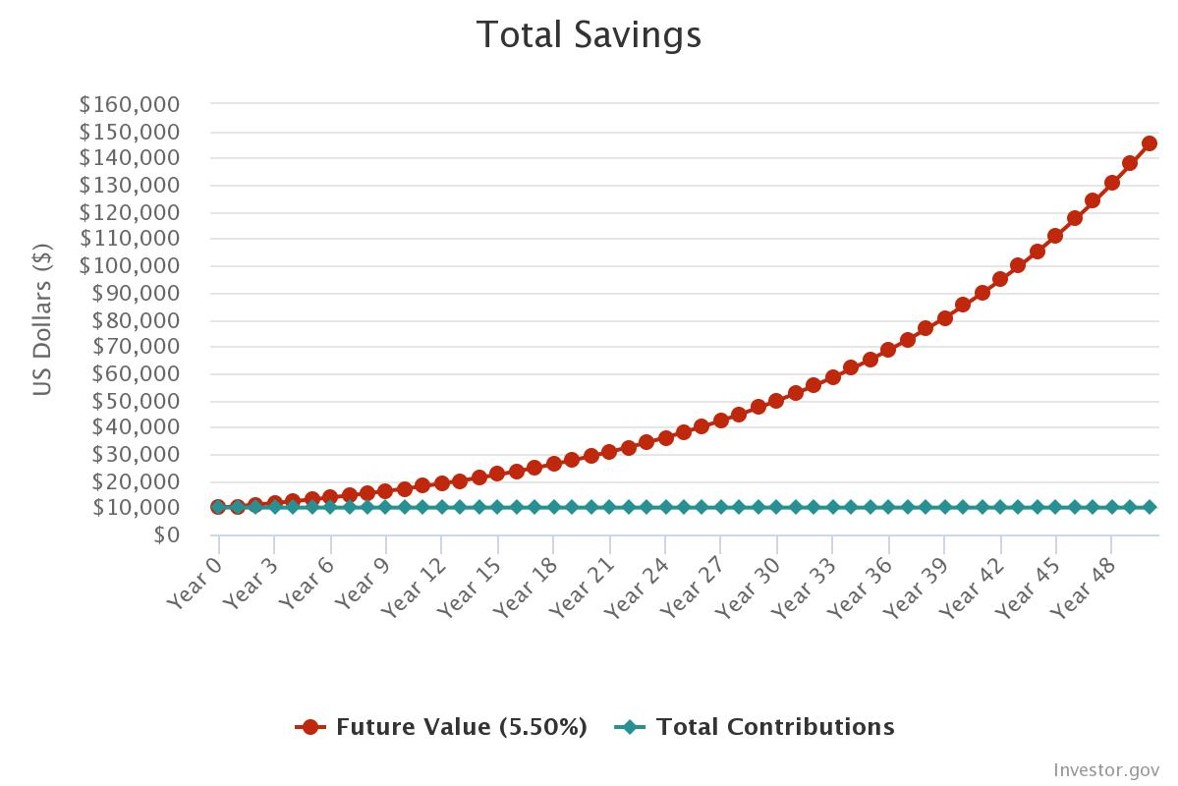

To ensure you completely understand this concept, we will use an example of an investment account earning 5.5% (roughly the current yield on a 6-month treasury bill). Say you invest $10,000 in that account at the beginning of 2023 and leave it in the account until the end of the year, the account would be worth $10,550. (5.5% of $10,000 is $550 in interest earned + the initial $10,000 investment). Now assume you reinvest the money into a treasury bill in 2024 earning the exact interest of 5.5%. By the end of the year your account will now be at $11,130.25 (5.5% of $10,550 is $580.25 in interest earned + the previous balance of $10,550). Fast forward to your 10th year repeating this process you would have $17,081.44 in the account. Fast forward another 10 years to your 20th year repeating this process, and your account would be at $29,177.57. Finally, let’s assume you’re a very patient person and repeat this process for 50 years, without investing any more than your initial investment of $10,000, your account would be worth $145,419.61. This effect is illustrated in the graph above. The contributions remain the initial investment, however, the interest grows exponentially over time. This example assumed no further contribution after the initial investment of $10,000. We also assumed a fairly conservative rate of 5.5% (the average return of the stock market for the last 50 years was 10.5%). We hope this illustrates how wealth can be accumulated, simply by consistently saving and investing over a long period of time.

Now that we understand what Einstein meant when he said, “he who understands it, earns it.” It’s important to also note what he meant when he said, “he who doesn’t, pays it”. Debt has the same effect. Credit card debt is a huge problem in America, with people not understanding the large snowball effect of debt they are creating personally. This debt lowers an individual’s credit score and hinders them from taking on good debt, such as a mortgage on a home. The average American has about $6,000 in credit card debt. The average interest on this debt is 25% annually, with some as high as 29%. The same exercise used above illustrates how this snowball effect can become a problem if managed poorly.

Here at Schenley Capital, we focus on creating strategies that help you maximize the potential of compound interest. Whether it is retirement planning, saving for your child’s future college expenses, or even managing debt. We help shape investment plans that help achieve these goals, along with comprehensive financial planning for all other aspects of life. Reaching your financial goals is a lifelong project – the sooner you start and the more you contribute, the quicker you can enjoy the benefits. We encourage our clients to open tax-advantaged accounts such as Roth IRAs, Traditional IRAs, and 529 accounts. Schedule a meeting to talk further with us about our financial strategies!

Schenley Capital Inc.

417 Walnut Street, Suite 200

Sewickley, PA 15143

(412)-749-9256